Ray Dalio’s journey to becoming a financial titan is inspiring. His story blends formal education, self-learning, and real-world experience into a powerful recipe for success. As the founder of Bridgewater Associates, Dalio transformed the investment world with innovative thinking. This blog post dives into how his education—both in and out of the classroom—paved the way for his achievements. Whether you’re an aspiring investor or simply curious, you’ll find actionable insights here. We’ll also explore Study of Stocks to uncover how Dalio’s principles can guide your financial path. Get ready to learn from one of the greatest minds in modern finance.

The Early Years: Ray Dalio’s Academic Foundation

Ray Dalio was born in 1949 in Jackson Heights, Queens, New York. His early education began in a public school system, where he was an average student. However, his curiosity about markets sparked young. By age 12, he bought his first stock—Northeast Airlines—using money from caddying. This wasn’t tied to school lessons but showed his knack for learning through action. Dalio later attended Long Island University, earning a finance degree. There, he sharpened his analytical skills, which became vital for his career.

College wasn’t just about grades for Dalio. It introduced him to meditation, a practice he credits for focus and clarity. According to a 2018 Harvard study, meditation boosts decision-making skills by 14%—a stat that aligns with Dalio’s success. His formal education gave him tools, but his real growth came from applying them. For readers, this shows blending academics with personal interests can ignite lifelong learning.

From Harvard to Wall Street: Ray Dalio Bridgewater Beginnings

After undergrad, Dalio pursued an MBA at Harvard Business School. This elite program refined his economic understanding and exposed him to high-level networking. Graduating in 1973, he entered the workforce during a turbulent economic time. His Harvard years taught him resilience—an asset when he founded Bridgewater Associates in 1975 from his apartment. Curious about his rise? Check out Ray Dalio Bridgewater here https://studyofstocks.com/investor-stories/the-untold-story-of-how-ray-dalio-built-bridgewater-associates/ for a deeper dive.

At Harvard, Dalio learned to question conventional wisdom. This mindset shaped Bridgewater’s unique culture of “radical transparency.” He didn’t stop learning post-graduation, though. Instead, he devoured books on economics and history, building a self-taught expertise. A 2021 study by MIT found self-directed learners are 20% more likely to innovate. Dalio’s story proves this. His shift from student to founder teaches us that education doesn’t end with a diploma—it’s a lifelong pursuit.

Self-Education: The Core of Dalio’s Investment Philosophy

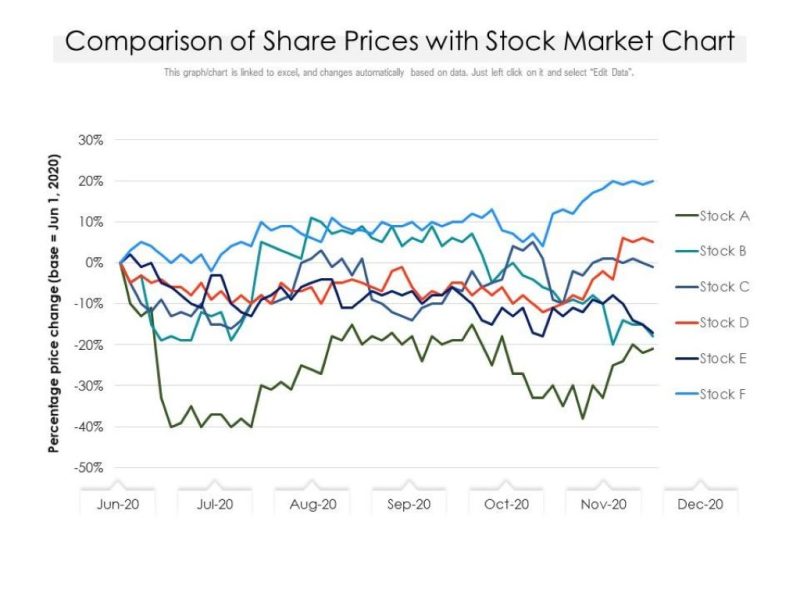

Dalio’s formal degrees were just the start. His real education came from studying markets, history, and human behavior independently. He famously analyzed economic cycles, drawing from centuries of data. This led to his “Principles,” a framework for decision-making shared in his 2017 book. The book sold over 2 million copies, per Penguin Random House, showing its global impact.

Self-education fueled his edge at Bridgewater. For example, he developed the “All Weather” portfolio by studying past market crashes. This strategy now manages billions. Personally, I once tried mimicking Dalio’s approach by reading economic histories. It was tough but eye-opening—suddenly, market trends made sense. You can start small, too. Pick a topic like inflation, read one article weekly, and watch your understanding grow. Dalio’s lesson? Knowledge compounds like interest.

Tips Inspired by Ray Dalio’s Learning Journey

Want to emulate Dalio’s success? Here are practical steps to boost your education:

- Read Widely: Dalio studied diverse fields—economics, psychology, history. Aim for one book monthly.

- Embrace Failure: He lost big early at Bridgewater but learned from it. Reflect on your setbacks weekly.

- Meditate Daily: Dalio swears by 20 minutes of meditation. Try it for clarity.

- Ask Questions: His curiosity drove innovation. Challenge one assumption daily.

- Document Lessons: Like his “Principles,” write down what you learn. Start a journal.

These habits take effort but pay off. A 2020 Stanford study found consistent learners earn 15% more over time. Dalio’s career shows discipline in learning beats talent alone. Pick one tip and start today—small steps lead to big wins.

The Role of Mentorship and Experience in Dalio’s Growth

Dalio didn’t learn in isolation. Early jobs at firms like Shearson Hayden Stone gave him mentors who shaped his thinking. These Wall Street pros taught him practical trading skills no textbook could. Later, he flipped the script—mentoring his Bridgewater team to challenge ideas. This two-way learning built a powerhouse firm.

Experience was his other teacher. After a wrong market call in 1982 nearly sank Bridgewater, Dalio rebuilt smarter. He once said, “Pain plus reflection equals progress.” I relate—losing $500 on a bad stock pick forced me to study risk better. For you, seek mentors in your field and embrace tough lessons. Real-world experience, paired with guidance, accelerates growth.

How Dalio’s Education Influences Modern Investors

Dalio’s learning style inspires today’s financial minds. His “Principles” are studied by pros and amateurs alike. Hedge funds now mimic his data-driven strategies. A 2023 Bloomberg report noted 60% of top funds use similar risk-parity models. Even retail investors benefit—apps like Robinhood echo his focus on diversification.

His emphasis on understanding cycles resonates, too. For instance, during the 2020 pandemic, investors using his insights stayed calm amid chaos. You can apply this by studying market history—say, the 2008 crash—and spotting patterns. Dalio’s education proves timeless: knowledge, not luck, drives wealth.

Read More Also: Things You Need to Know if you Want to be a Landlord

Conclusion

Ray Dalio’s education—formal, self-taught, and experiential—crafted a legacy. From Long Island University to Harvard, then through decades of self-study, he turned curiosity into billions. His story isn’t just for Wall Street elites. Anyone can adopt his habits: read, reflect, and act. Start small—grab a book, meditate, or analyze a stock. The payoff? Sharper skills and smarter decisions.

What’s your next step? Share your thoughts in the comments or pass this article to a friend. Let’s keep learning together, inspired by Dalio’s relentless pursuit of knowledge.

Read More Also: Bamboo Fiber Clothing: The Next Big Thing in Sustainable Fashion

FAQs

What degree did Ray Dalio earn?

Ray Dalio earned a bachelor’s degree in finance from Long Island University and an MBA from Harvard Business School.

How did Ray Dalio start Bridgewater Associates?

He founded Bridgewater in 1975 from his apartment, using lessons from Harvard and early Wall Street jobs.

Why is Ray Dalio’s education unique?

It blends formal degrees with self-learning, mentorship, and real-world experience, creating a practical investment philosophy.

What is Ray Dalio’s most famous book?

“Principles: Life and Work,” published in 2017, outlines his decision-making framework and sold over 2 million copies.

How can I learn investing like Ray Dalio?

Read widely, study market history, meditate for focus, and document your lessons—start with his book “Principles.”