Money orders are popular for their safety as a form of payment. Do they expire? Can you deposit or cash them anytime, regardless of their age? In this article, we’ll uncover the truth about money orders’ shelf life.

It’s important to note that money orders never expire, unlike perishable goods or certain financial instruments. This means that you can cash or deposit a money order no matter how old it is. In terms of financial instruments, if you’re curious about how does kibo pay make money, they generate income through transaction fees and exchange rate markups. Additionally, Kibo Pay has been making strides in the business world.

But before you start digging through your drawers for that ancient money order you received as a gift from your grandma years ago, there are a few important details to consider.

Beware of Dormancy Fees

While money orders themselves don’t expire, some financial institutions may impose what’s known as a “dormancy fee” if a money order remains uncashed or undeposited for an extended period. These fees can vary from institution to institution, but they typically kick in after 1 to 3 years of inactivity.

To avoid these pesky fees, it’s a good idea to keep track of your money orders and ensure they are cashed or deposited within a reasonable timeframe. If you have a money order that’s been gathering dust for a while, it’s wise to contact the issuing financial institution to inquire about any fees that may have been applied.

Special Requirements for Old Money Orders

Financial institutions may sometimes have specific requirements for cashing or depositing older money orders. They might ask for additional identification or documentation to verify the transaction’s legitimacy. These requirements are in place to prevent fraud and ensure the money order is still valid.

Tips for Using Money Orders

Now that we’ve covered the basics of money order longevity let’s explore some useful tips for handling them:

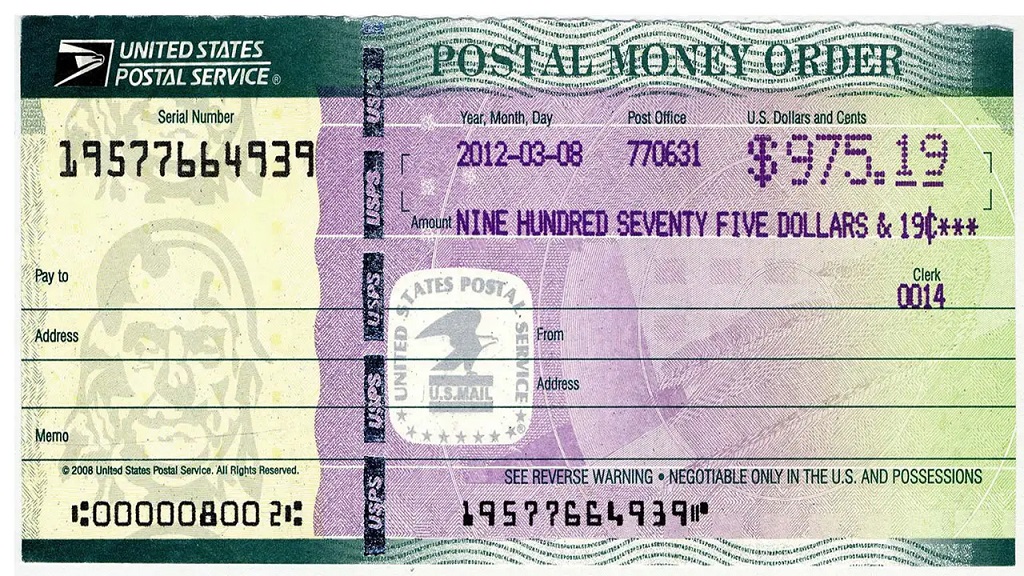

1. Keep a Copy of the Receipt

Always keep a copy of the money order receipt. This little piece of paper is proof of purchase and can be a lifesaver if your money order is ever lost or stolen. It contains essential information about the transaction, including the money order’s serial number and the recipient’s name.

2. Fill Out the Money Order Correctly

When filling out a money order, do so accurately and completely. This includes legibly writing the recipient’s name, specifying the exact amount, and providing your signature. Accuracy reduces the risk of complications when the recipient tries to cash or deposit the money order.

3. Use Certified Mail for Mailed Money Orders

If you’re sending a money order through the mail, opt for registered or certified mail services. This additional layer of security provides tracking information and insurance in case the money order gets lost or damaged in transit. It’s a small investment for peace of mind.

4. Contact Your Financial Institution

If you have any questions or concerns about using money orders, don’t hesitate to contact your financial institution or the issuing financial institution. They can provide guidance and address any specific queries you may have.

Conclusion

Money orders are indeed the timeless treasures of the financial world as they don’t come with expiration dates. Nevertheless, it’s crucial to stay vigilant about potential dormancy fees and any specific requirements that might be associated with aging money orders. How your business can save money, especially when dealing with these financial instruments, is by following the tips in this article. By doing so, you can continue to make the most of this secure payment method without the burden of worrying about expiration dates.

FAQs

- Do money orders have an expiration date?

No, money orders do not have an expiration date. You can cash or deposit them at any time.

- What are dormancy fees for money orders?

Dormancy fees are charges some financial institutions impose if a money order remains unused for an extended period, typically 1 to 3 years.

- Can I cash an old money order without any issues?

While money orders don’t expire, some institutions may have specific requirements for cashing or depositing older ones. It’s a good idea to check with the issuing financial institution.

- Why should I keep a copy of my money orders receipt?

Keeping a copy of the money orders receipt serves as proof of purchase and can be helpful if the money order is lost or stolen.

- Is it safe to send money orders through the mail?

It’s safer to send money orders through registered or certified mail, as this provides tracking and insurance in case of loss or damage during transit.